Levi Strauss & Co. Announces Third-Quarter 2014 Financial Results

SAN FRANCISCO (October 6, 2014) – Levi Strauss & Co. (LS&Co.) announced financial results today for the third quarter ended August 24, 2014.

Highlights include:

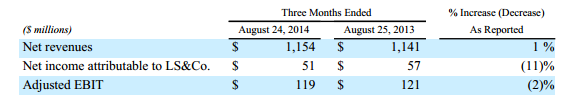

Net revenues grew one percent on both a reported and constant-currency basis. Increased sales from the company's global retail network were partially offset by lower sales at wholesale in the Americas. Third quarter net income declined to $51 million reflecting charges associated with the company's global productivity initiative. Adjusted EBIT declined two percent to $119 million reflecting a lower gross margin and increased advertising investment, partially offset by savings realized from the initiative.

“Despite continued external challenges, including soft retail traffic and a highly-promotional environment, we grew revenue in the third quarter by focusing on the controllable aspects of the business. The decline in net income essentially reflects the investments we're making to improve productivity,” said Chip Bergh, president and chief executive officer. “As we enter the fourth quarter, we remain confident in our ability to grow sales and adjusted EBIT this year, as we continue to focus on driving retail conversion, engaging with consumers globally with our Live in Levi’s® campaign, and improving the structural economics of our business.”

Third-Quarter 2014 Highlights

Gross profit in the third quarter declined to $562 million compared with $573 million for the same quarter of 2013. Gross margin for the third quarter declined to 48.7 percent of revenues compared with 50.2 percent of revenues in the same quarter of 2013. The gross margin decline was primarily due to higher product costs and an increase in discounted sales across channels, reflecting a promotional retail environment and efforts to manage high inventory levels.

Selling, general and administrative expenses (SG&A) for the third quarter of $455 million were flat compared with the same quarter of 2013. Increased advertising investment and consulting fees primarily related to centrally-led costsavings and procurement projects associated with the company's global productivity initiative were offset by SG&A savings realized from the initiative and a decline in incentive compensation expense.

Operating income of $105 million in the third quarter was down from $118 million in the same quarter of 2013 primarily due to the lower gross margin. Increased advertising investment and the charges associated with the company’s global productivity initiative were partially offset by savings realized from the initiative.

Adjusted EBIT, which excludes the charges associated with the company’s global productivity initiative, was $119 million, a decline of two percent compared with the same quarter of 2013. A reconciliation of Adjusted EBIT is provided at the end of this press release.

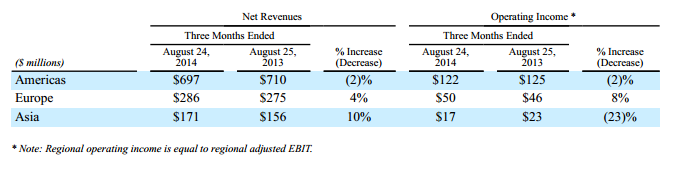

Reported regional net revenues and operating income for the quarter were as follows:

• Net revenues in the Americas declined primarily due to lower sales of women’s products at wholesale. Operating income declined due to the region’s lower net revenues. A decline in gross margin was offset by lower SG&A.

• In Europe, net revenues and operating income growth resulted from performance and expansion of the companyoperated retail network and higher gross margins.

• In Asia, net revenues grew in the company-operated retail network and at wholesale, primarily driven by pricepromotional activity. Operating income declined due to the region's lower gross margin, reflecting the highlypromotional environment.

Cash Flow and Balance Sheet

At August 24, 2014, cash and cash equivalents of $367 million were complemented by $606 million available under the company's revolving credit facility, resulting in a total liquidity position of approximately $1.0 billion. Net debt at the end of the third quarter remained less than $1.1 billion. Free cash flow through the third quarter of 2014 was $4 million. The company has revised its estimate of capital expenditures for 2014, which it now projects will be in the range of $80 – $90 million.

Source: http://www.levistrauss.com/wp-content/uploads/2014/10/Exhibit-99-1-3Q-2014-Press-Release.pdf